Share

Minimum Wage in Romania in 2025: Current Level, Evolution and Outlook

In recent years, the minimum wage has become one of the most important labour-market indicators in Romania. It directly affects more than one million employees and puts pressure on company costs, but it is also a political and social tool used to protect the incomes of the most vulnerable workers. In 2025, Romania entered a new phase: the minimum wage is higher, the rules for setting it are clearer, and from 1 January 2026 it will be calculated according to the new European mechanism for an “adequate minimum wage.”

1. What is the minimum wage in 2025 and to whom it applies

Starting 1 January 2025, the gross minimum wage in Romania is set at 4,050 RON. This level applies to all full-time employees, regardless of sector, except for fields that benefit from special minimum wages, such as construction. The minimum wage refers to the guaranteed gross base salary and does not include bonuses, allowances or other wage supplements. In 2025, the minimum wage continues to be accompanied by the 300-RON tax exemption, which increases the take-home pay of employees receiving the minimum wage.

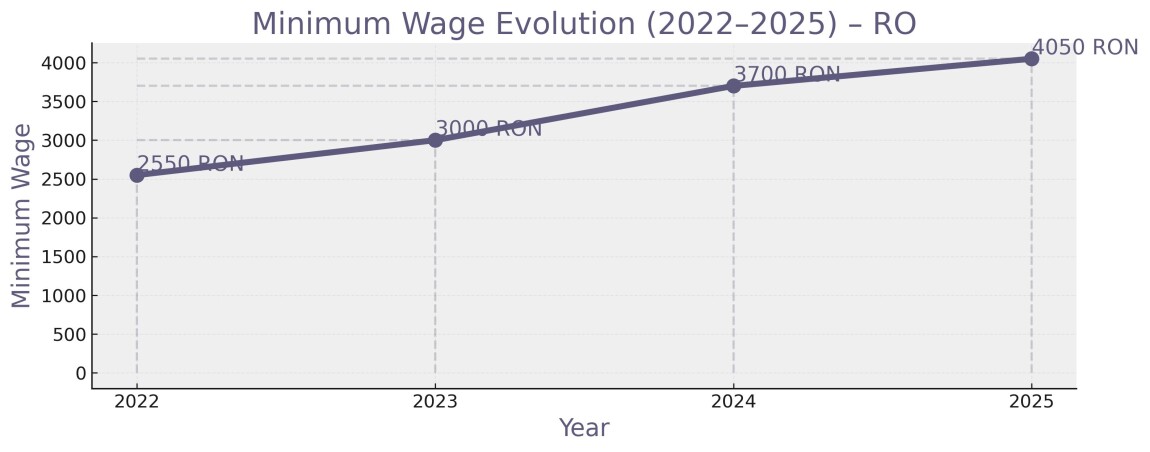

2. How the minimum wage evolved in recent years (2022–2025)

The period 2022–2025 has been one of the most dynamic in terms of minimum-wage developments. In 2022 the minimum wage stood at 2,550 RON. In 2023 it increased to 3,000 RON and later to 3,300 RON toward the end of the year. In 2024 it rose again to 3,700 RON, and in 2025 it reached 4,050 RON. These rapid increases were driven by inflationary pressure and the objective of aligning Romania with European standards for adequate minimum wages. At the same time, the transposition of the 2022 EU Directive introduced the requirement that the minimum wage be updated annually based on objective indicators such as cost of living, productivity and overall wage dynamics.

3. What the minimum wage looks like in practice in 2025 (gross, net, taxes, employer cost)

In 2025, a gross minimum wage of 4,050 RON results in a net salary of approximately 2,574 RON, taking into account the standard deduction and the 300-RON non-taxable amount. The employer cost slightly exceeds the gross amount due to the labour-insurance contribution. Compared to 2024, the increase brings higher net income for employees and a higher mandatory cost for employers. These figures apply to standard employment contracts paid at the general minimum wage, without additional benefits or special tax exemptions.

4. The 300-RON tax exemption in 2025: how it works

The tax exemption of 300 RON continues to apply in 2025 for employees earning exactly the legal minimum wage. This amount is not subject to income tax or social contributions, which results in a slightly higher net salary than would normally result from standard tax calculations. The exemption applies only if the employee’s base salary is exactly the minimum wage and if that job is their primary employment. This measure reduces the fiscal burden and is one of the government’s tools for supporting workers at the lowest income levels.

5. Sectors with special minimum wages (construction and others)

Alongside the general minimum wage, Romania maintains in 2025 a special minimum wage for the construction sector, where the minimum gross level remains around 4,582 RON. This reflects the sector’s strategic importance and the measures introduced in previous years to address labour shortages and stimulate investment. By contrast, other sectors that once benefited from differentiated minimum wages, such as agriculture and the food industry, have been aligned with the general minimum wage following the removal of previous tax exemptions. Thus, in 2025 only the construction sector retains its distinct minimum-wage threshold.

Conclusions

The year 2025 confirms the trend of accelerated minimum-wage growth in Romania, amid rising living costs and the transition to European rules on adequate minimum wages. The new level of 4,050 RON, together with the 300-RON tax exemption, provides workers with a tangible increase in net income, but also generates additional costs for employers. With construction remaining the only sector with a special minimum wage and with clearer legislation in place, 2025 stands out as a transitional year toward a more predictable and standardised wage-setting system. If recent trends continue, another increase is likely to occur in 2026.

Article written by:

Comments

0 comments

Access your account and add your comment

Legislative

Subscribe to the Newsletter

Read articles of interest from Undelucram.ro contributors